Your Dedicated Workers' Compensation Attorneys

If you have been injured on the job then you might think you know everything there is to know about Workers' Compensation benefits, however, not every Workers' Compensation situation requires the use of every single benefit or law. Our bilingual staff is here to help you when you need it most. We've been protecting the rights of workers since 1991. When you're ready to discuss your case, our New York workers’ compensation lawyers will be able to answer your questions. Contact us today to schedule an initial consultation.

Table of Contents

While workers’ compensation is a mutually beneficial system for employers and employees, there will be many obstacles to overcome. Unfortunately, receiving workers’ compensation benefits is not always as straightforward as it seems. The case may take different paths, but having the necessary legal experience will be imperative to gaining the best opportunity for the situation, especially when complications such as claim denials arise.

Accepted Injuries for Workers' Compensation Benefits

The Workers' Compensation system in the U.S. dates back as far as the early 1900s and is essential for both workers and employers today. Workers' Comp is mutually beneficial because it protects the employer from legal action being taken by the employee.

Most importantly, Workers' Compensation ensures injured employees receive the benefits they need and protects them from retaliation on the part of their employer. The injured employee waives their right to file a claim or lawsuit against their employer in exchange for these benefits. Be aware that in addition to qualifying for one of the below injuries or illnesses, the employee must also meet the work-related requirements. Acceptable injuries that may allow for Workers' Compensation benefits include:

- Repetitive Motion Injuries

- Illness & Disease from Exposure to Harmful Materials

- Pre-Existing Conditions

- Stress Injuries

Injuries on the job could include electrocution, slip and falls, being struck by an object, car accidents, and more. Victims with injuries should take immediate action by reporting the accident to their employer and seeking legal counsel.

What You May Not Receive Coverage for

Although Workers' Compensation may cover many work-related injuries, keep in mind that some accidents will not qualify. Workers' Compensation is considered a no-fault system, meaning regardless of whether the accident was the fault of the employer or employee- they will still have the ability to access available benefits. Unfortunately, there are a few types of accidents that may not allow a victim to receive these benefits, such as:

- The employee was under the influence of drugs or alcohol

- The accident was a result of “horseplay” or fighting

- The employee was committing a crime when the accident occurred

- Car accidents that happen during the employee’s commute

- Accidents that do not require medical care

Dealing with a work-related injury that does not qualify for Workers' Compensation benefits can be incredibly frustrating, especially when contending with lost wages and exorbitant medical costs. Victims may face financial ruin on top of lasting injuries and work limitations. Because of this, it’s vital to explore available options with the guidance of an experienced lawyer.

Managing Complicated Cases

Regardless of whether injuries qualify or not, victims should always consider speaking with a lawyer. With their guidance, it may be possible to find alternative solutions, especially when facing a claim denial or an accident that does not allow for Workers' Compensation benefits. There may even be a third party who can be held accountable for negligence at times. For example, if a person was in a car accident during their commute to work, they won’t qualify for Workers' Compensation. Still, they may pursue a settlement from the driver who was responsible for the accident.

Determining Your Monthly Workers' Compensation Benefits

To do this you once again have to do a little math.\ You will take the amount of your weekly workers’ compensation benefit, whatever you receive each week, and you will multiply it by 52 (because there are 52 weeks in a year). After this, you will get a number that you would divide by 12, which will help you receive your monthly workers’ compensation benefits throughout the year.

Determining Your Average Earnings

An example to figure out your average current earnings and what that reduction would look like is below:

- First, you should understand that your average earning is calculated by averaging your highest consecutive five years of earnings or by taking the highest year that you earned in the five years before receiving disability.

- So if your highest amount of earnings was $40,000, you would divide that by 12 to get your monthly earnings, which would be $3333.33.

- From there you would multiply the number you received as a monthly earnings by 80% to see what your average current earnings would be. In this scenario, the earnings would be $2666.

The Effect on Your Social Security Benefits

If you are receiving Social Security disability benefits and you need to receive workers’ compensation, you can only receive up to 80% of your average earnings between both benefits. This means that if you are filing for Social Security disability benefits after receiving workers’ compensation benefits, you will not be able to collect the maximum amount of Social Security benefits that your earnings record would give you.

Essentially, if your benefits average together exceed 80% of your current earnings, the disability benefit will be reduced. If you believe that your workers’ compensation case has wrongly reduced your Social Security benefits, you should reach out to a workers’ compensation lawyer in New York to make sure that everything has been done correctly.

Sit Down With Attorney Adam Rosen to Discuss the Facets of Workers' Compensation Cases for Uber and Lyft Drivers:

Dos and Don'ts for Your Workers' Comp Claim

We work hard to set our clients up for success. While there are millions of workplace injuries reported in the US each year, workers’ compensation claims are not something that the average person deals with. So, when someone is injured at work, they may be unsure about how to proceed. Still, you don’t have to fight for your benefits alone.

- Don't: Wait To Notify Your Employer

If you are injured at work and have received medical attention you should notify your employer immediately. More specifically, you should notify your employer in writing. Waiting to provide notification, and failing to do so in written form may hurt your case in the long term. To increase your chances of success you need to establish a record of your injury and pursue benefits sooner rather than later.

- Do: Hold On to Your Medical Records

After you’ve been treated by a healthcare provider, make sure that you keep any billing information that relates to your treatment. When the time comes for you to file for benefits, having invoices is essential to receiving compensation for your medical treatment. Our Workers' Comp lawyers will tell you that this is one of the most important parts of a successful claim.

- Don't: Be Afraid to File

Filing for workers’ compensation benefits can be frightening to some people. Oftentimes, victims of workplace injuries mistakenly believe that they are taking action against their employers. This is not the case. Your employer has a legal duty to provide insurance benefits to injured workers. Filing a claim for workers’ compensation is simply a formalized process to request these benefits. There is no need to be afraid of filing.

- Do: Consult an Attorney if You Have Any Questions

As you can see, there are many things to consider when it comes to filing a workers’ compensation claim. You and your family likely have enough on your plate already. It is nice to have a lawyer at your disposal. Not only can we answer your questions, but we can also advocate and fight for you should the situation call for it.

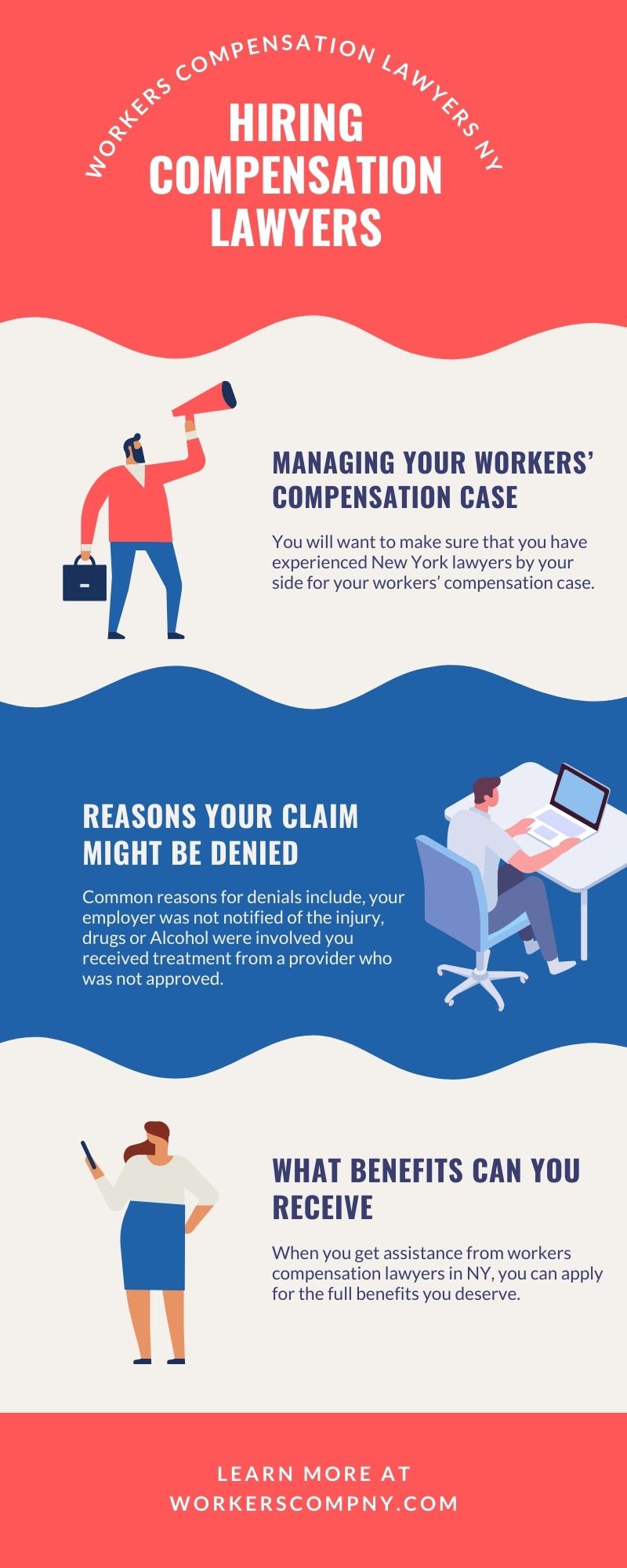

New York Workers' Compensation Infographic

New York Workers’ Comp Stats

According to the Bureau of Labor Statistics, almost 4 million workers’ compensation claims are filed each year in the U.S. The most common types of Workers' Compensation claims are injuries to the back, neck, and head. The average claim is about $30,000.

The state of New York has the highest number of work injuries in the country. There are an estimated 150,000 workers’ compensation claims filed each year. Education and health occupations have the highest number of injuries, followed by trade, transport, and utilities jobs. Third and fourth on the list are manufacturing and construction. The majority of claims are filed by workers employed by private companies.

Workers’ compensation benefits can include medical care, lost wages, and vocational rehabilitation. If you have been injured on the job, contact one of our workers’ comp lawyers to find out what benefits you may be entitled to. We can also help you if your workers’ claim has been denied.

Frequently Asked Questions

What Is Workers' Compensation?

Workers’ compensation insurance provides financial protection for employees who are injured or become ill due to the work that they do for the employer. If you need help filing a workers’ compensation claim, we can assist you.

Who Pays Workers' Compensation To Employees?

Most employers purchase Workers' Compensation insurance and the insurance company pays benefits to employees. However, except for in states where employers are required to purchase insurance coverage, some employers may opt to pay benefits themselves or self-insure.

Can an Employee Get Disability, Unemployment or Social Security While Receiving Workers' Compensation Payments?

Receiving workers’ compensation payments does not make employees ineligible for other benefits, but it may affect which benefits they can receive. We may be able to help you determine how workers’ compensation affects your other benefits.

What Does Workers' Compensation Cover?

Workers’ compensation may provide benefits for medical expenses, ongoing care costs, lost wages, and funeral expenses that result from an illness or injury that is related to your work.

What Does Workers' Compensation Not Cover?

State laws determine what types of injuries and illnesses are not covered by workers’ compensation. Attorneys may be able to help determine whether your injuries should be covered. There are several common examples of injuries that may not be covered:

- Injuries sustained in a fight started by the employee

- Intentional injuries

- Injuries an employee sustains because of working while intoxicated

- Emotional injuries not caused by physical workplace trauma

What Should I Do If I Get Hurt at Work?

Report your injury to your supervisor immediately. If you have a work-related illness, report it to your employer as soon as you receive a diagnosis or become aware that your illness is related to your work. Seek medical attention.

How Are My Benefits Calculated?

Most workers’ compensation insurers pay medical expenses directly to the providers and may require pre-approval for some services. If you are unable to work because of your injury or illness, you may receive a percentage of your average weekly wage. If you believe you are not receiving the correct benefits, our New York Workers' Comp lawyers can help you.

Who Decides When I Can Go Back To Work?

When you can return to work depends on any work restrictions your doctor gives you and what your employer's return-to-work policy is. If there is a dispute between you and your employer about whether you can return to work, our team will be able to assist you.

In the wake of an on-the-job injury, you will need to take not only action but also to make several decisions. We have seen many people struggle with the twists and turns that may come with pursuing workers’ compensation benefits. We want to help you by advocating for the benefits that you deserve. To schedule a consultation, call our New York office today.

Why Might My Employer Dispute Workers' Comp Benefits?

As an injured worker, there is nothing more disheartening than to learn that your employer is disputing the validity of your claim. Common reasons an employer might dispute a workers’ compensation claim include:

- The employer failed to seek medical treatment after the accident

- The employer did not report the injury to their employer

- The injury didn’t occur from work-related duties

- The injuries weren’t serious enough to require time away from work

- The employer does not believe the claim is valid

What's The Purpose Of A Third-Party Claim In Workers' Compensation Cases?

In some cases, a person may seek both workers’ compensation benefits and compensation from an insurance claim. When another party can be held accountable for the accident (aside from the employer), victims may be able to pursue a third-party claim from the responsible party. Examples of third-party claims include:

- Negligent driver in a car accident

- Product manufacturers for defective products

- Property owners

- +More

Workers' Compensation Glossary

For over thirty years, our NY Workers' Compensation lawyers have helped clients understand important terms, allowing them to navigate the legal process. Workers' Compensation law benefits employees who are injured or become ill due to their work. This system is designed to provide financial assistance and medical care to workers while limiting employers' legal liabilities. However, workers’ compensation law can be complex, especially when dealing with disputes, delayed claims, or non-straightforward injuries.

Claim Denial

A claim denial occurs when an insurance company or employer rejects an employee’s request for Workers' Compensation benefits. This may happen for reasons such as insufficient evidence, lack of medical documentation, or the injury being deemed unrelated to work. In some cases, claim denials can be appealed, and our skilled NY Workers' Compensation lawyer can help injured workers fight these decisions, often by gathering additional evidence or requesting a hearing before the Workers' Compensation board.

Repetitive Motion Injuries (RMIs)

Repetitive motion injuries are caused by repetitive actions or movements over a long period of time, leading to strain on muscles, tendons, and nerves. Common examples include carpal tunnel syndrome, tendonitis, and bursitis. RMIs are often difficult to prove in Workers' Compensation claims because they develop over time and may not be linked to a specific accident. However, they are still recognized as valid work-related injuries and can be compensable under Workers' Compensation law with the proper documentation and legal representation.

No-Fault System

A no-fault system means that workers’ compensation benefits are provided regardless of who is at fault for the accident or injury. This system simplifies the process by ensuring that workers receive benefits without needing to prove negligence or assign blame to their employer. While this streamlines the claim process, workers may still have to deal with issues such as the extent of the injury or the appropriate amount of compensation. At Polsky, Shouldice & Rosen, P.C., our NY Workers' Compensation lawyers can ensure that the injured worker receives the benefits to which they are entitled.

Third-Party Liability

Third-party liability in workers’ compensation refers to situations where an employee’s injury is caused by a party other than the employer or co-worker. For example, if a worker is injured in a car accident caused by another driver while on the job, the employee may be able to file a lawsuit against the third party in addition to receiving Workers' Compensation benefits. This allows the injured worker to potentially recover additional damages, such as pain and suffering, that Workers' Compensation benefits do not cover.

Average Weekly Wage (AWW)

The Average Weekly Wage (AWW) is used to calculate the amount of compensation an injured worker is entitled to while recovering. It is typically based on the worker's earnings over a set period leading up to the injury. AWW can include salary, overtime, and bonuses. It is also used to determine temporary total disability benefits, which replace a portion of the worker's lost income. In some cases, fringe benefits or other types of compensation may also be included in the AWW calculation.

Polsky, Shouldice & Rosen, P.C.

500 Merrick Rd, Rockville Centre, NY 11570

Contact Our Team Today

When you’re dealing with the workers’ compensation process, having a skilled attorney on your side can make all the difference. We pride ourselves on our commitment to our clients and our experience in this field of law. Our team is here to guide you through the process and maximize your benefits after a workplace accident. We take a personalized approach to each case, tailoring our strategies to your unique situation, so you can be confident that your rights are being vigorously defended. Clients can rely on our skilled lawyers to serve their best interests.

If you’ve been injured in a workplace accident, let us be your trusted partners in securing the benefits you are entitled to, offering compassionate and professional support throughout your journey. We have practiced workers’ compensation law exclusively for over 30 years. Don't wait to contact our New York workers’ compensation lawyers at Polsky, Shouldice & Rosen, P.C., and learn about how you can seek your best result.

Client Review

"Polsky , Shouldice and Rosen is a competent law practice that delivers results. The office is always clean and inviting, and the staff is pleasant. They have parking in the back which makes things that much easier. I was lucky enough to have Adam L Rosen represent me in a Workers' Compensation case. Adam Rosen is a pleasant, down to earth and respectful individual. As for my case, he and his staff took care of everything, kept me informed and made the experience stress free along the way. Most importantly, he and his law firm delivered a relatively good result. I hope this review helps someone looking for a good lawyer."

Bigbang Jama